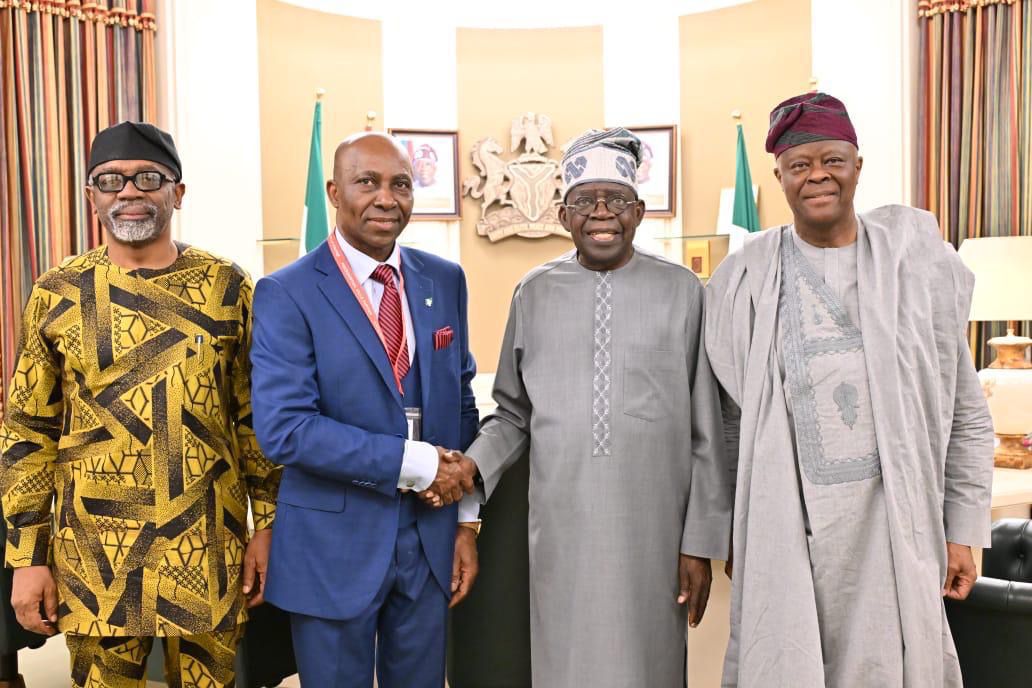

President Bola Ahmed Tinubu on Wednesday received Nigeria’s newly appointed Tax Ombudsman, John Nwabueze, at the State House in Abuja to mark the formal commencement of an oversight office created to address complaints and disputes within the country’s tax and revenue system.

The meeting comes as the Federal Government continues to roll out reforms aimed at improving tax administration, strengthening revenue governance and reducing long-standing frictions between taxpayers and public authorities. Also present at the meeting were the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, and the Chief of Staff to the President, Femi Gbajabiamila.

According to the presidency, the Office of the Tax Ombudsman is intended to function as an independent mechanism for resolving complaints arising from taxes, levies, customs duties and regulatory charges. The office is expected to provide a structured channel for individuals and businesses seeking redress over alleged unfair assessments, administrative bottlenecks or overlapping fiscal demands.

The creation of the ombudsman’s office forms part of broader fiscal and economic reforms under the Tinubu administration, which has placed increased emphasis on widening the tax base, improving compliance and boosting non-oil revenue while seeking to ease the cost of doing business.

In recent years, Nigeria’s tax environment has been characterised by complaints from businesses over multiple taxation by federal, state and local authorities, as well as disputes linked to customs duties and regulatory fees. Analysts have said these challenges have contributed to uncertainty for investors and increased operating costs, particularly for small and medium-sized enterprises.

The presidency said the new office is designed to improve transparency in tax administration and enhance dispute resolution processes, with the aim of making the system more predictable for taxpayers. By providing an avenue outside existing revenue-collecting agencies, the ombudsman is expected to act as an intermediary between the government and taxpayers while recommending corrective measures where necessary.

While details of the ombudsman’s operational framework, enforcement powers and reporting structure were not disclosed at the meeting, officials indicated that the office would cover complaints cutting across multiple revenue and regulatory bodies.

Nigeria has one of the lowest tax-to-GDP ratios globally, a challenge successive administrations have sought to address through reforms. The current government has argued that improving trust in the tax system and reducing perceived arbitrariness are critical to increasing voluntary compliance.

The Tinubu administration has also pursued wider economic reforms, including changes to fuel subsidies and foreign exchange policy, as part of efforts to stabilise public finances and attract investment. Within this context, the establishment of the Tax Ombudsman is positioned as an institutional measure to improve accountability in revenue administration.

The presidency said the initiative is aimed at strengthening public sector accountability and supporting a more balanced relationship between the state and taxpayers, as Nigeria seeks to build a more efficient and credible fiscal system.